Real Tips About How To Apply For Tax Rebate

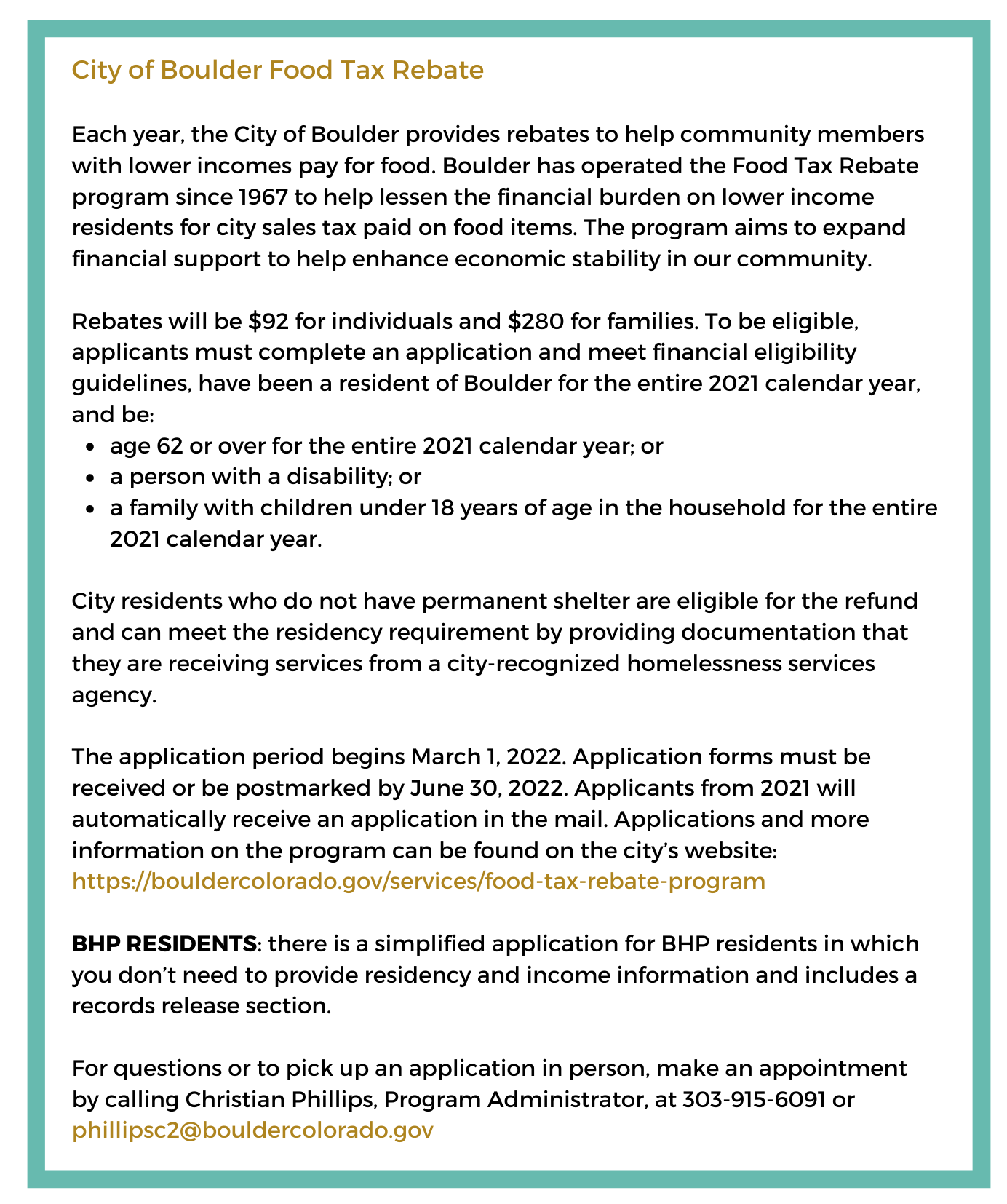

If you live in an eligible property and you pay your council tax by direct debit, your local council will generally make the payment directly.

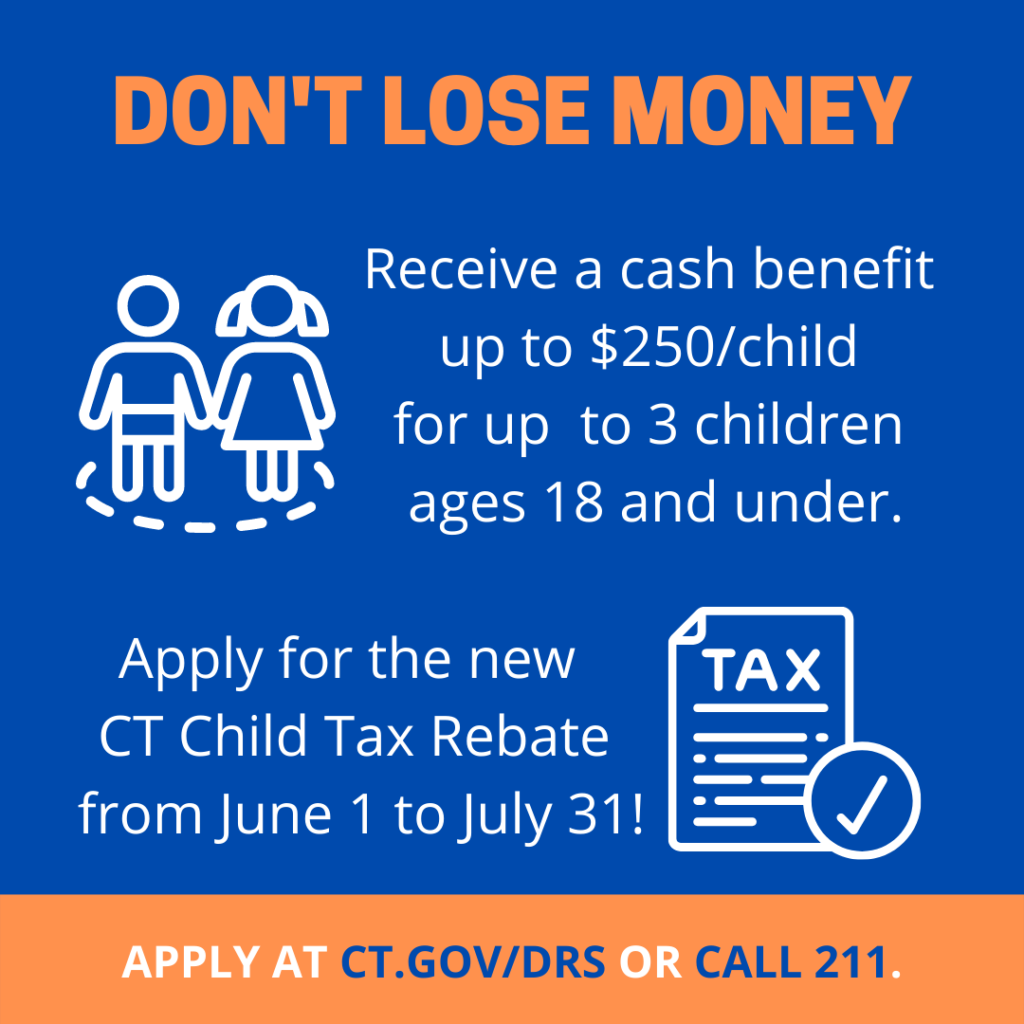

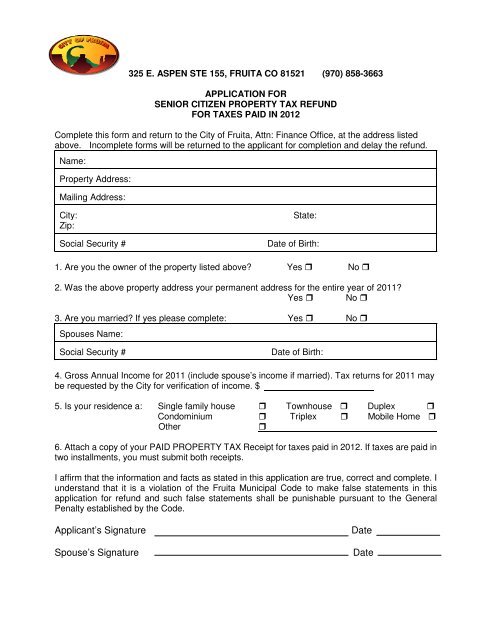

How to apply for tax rebate. Use this service to see how to claim if you paid too much on: To be eligible for this rebate you must meet all of the following requirements: $10,000 for all borrowers, and $20,000 for pell grant.

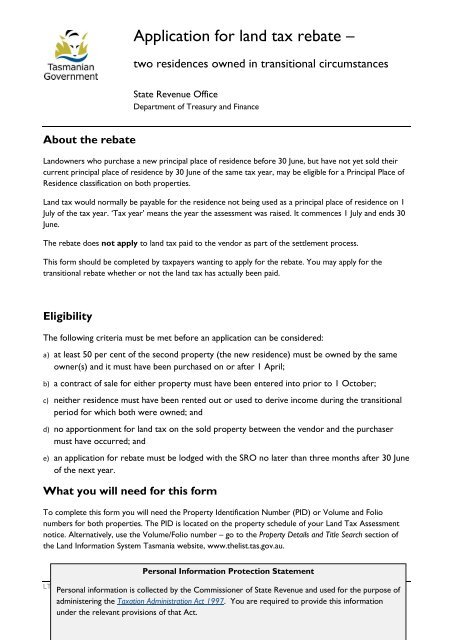

The internal revenue service announced last month it would abate certain penalties for people and businesses who file 2019 and 2020 returns late. Full time, seasonal/temporary, internship position. The local tax is due monthly, with returns and remittances to be filed on or before the 20th day of the month for the previous month’s sales.

Definition of income for the homeowner tax rebate credit for the homeowner tax rebate credit,. To apply for the credit, the first important thing to note is the deadline is coming fast—september 15 but the application can be done online, so there’s still time. The deadline for filing is dec.

Pro perty tax/rent rebate program filing options. Tax liability is the amount of tax you owe throughout the year minus. The online portal to apply for the state’s newest property tax savings program is open.

Payments will be issued no later than may 2023 via. You may be able to get a tax refund (rebate) if you’ve paid too much tax. Apply for a payment plan to pay your balance over time.

Renters can apply online or by downloading the application and returning by mail. If you are filing a rebate application for the gst/hst you paid on commercial goods that you exported, other than artistic works that you manufactured or produced, enter. The program, called anchor — short for the affordable new jersey communities for.

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)